Business financials are never easy, especially if you aren’t numbers savvy. Still, running a successful business often means a basic understanding of the numbers, and how these numbers explain if your business is working or not. Unfortunately, many business owners do not fully grasp the full value of their numbers, or they’re simply overwhelmed with the management of the finances themselves.

As a business owner, you might find yourself tracking receipts, monitoring your business accounts, and maybe at this point you’ve used a spreadsheet you’ve made yourself, or whatever accounting app was on hand.

Sometimes these things work. Other times, they don’t.

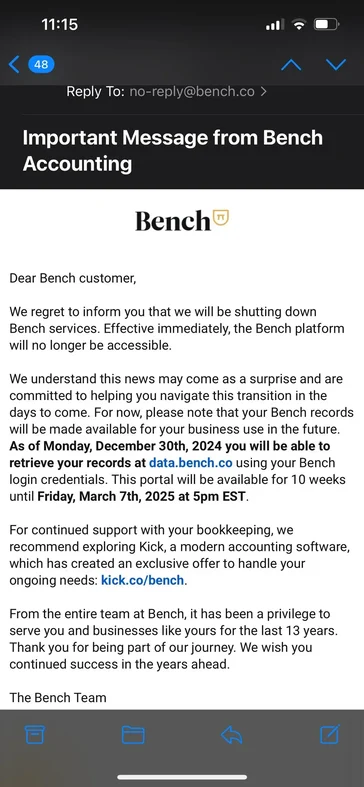

Just last year, one of the most well known bookkeeping apps shut down with no explanation. This left tens of thousands of business owners without any support, right when tax season was beginning and these services would have been most crucial.

These kinds of apps are common for small business owners, usually because their monthly fees are so cheap.

However, this software pales in comparison to what a professional bookkeeper can offer, and they usually offer the minimum on what you actually need to grow your business.

With this in mind, there are a multitude of signs that its time your business hired a professional bookkeeping service.

1) You’re Behind on Bills and Payments

One of the biggest red flags for a business is the inability to make payments on time. While this is most crucially important with payroll, having overdue invoices can accrue fees that drain your account and affect your cash flow.

These things often get pushed to the end of the day — or the end of the month — because it feels less urgent than working with your customers or running the business with your team.

When it comes to this pain point, ask yourself:

- Have you ever missed an important bill or invoice?

- Have you ever asked a vendor or service to waive a late fee?

- Have you ever moved around money last minute to cover payroll?

- Or can’t explain why your business account is shrinking?

If you said yes to any of these, you’re probably due to talk to a professional bookkeeper. As you’ve probably figured out, cash related issues often start as small problems, but they can quickly snowball into bigger, more serious pain points for your business.

This is especially true if you find yourself taking on debt to pay your business bills, with accruing interest that makes your financial situation worse.

2) You Feel Like You’re Growing, but Your Business Isn’t Profitable

Growth is usually a surefire sign of success in business… but more revenue does not always mean more profit. Many times, business owners celebrate seeing their sales increasing without realizing that the operating costs are also becoming a heavier load with each passing month.

It’s also not uncommon for business owners to not fully understand these operating costs, as well as not understand some of the terminology associated with it. This can be as simple as grasping the difference between revenue and profit, and it becomes more difficult as you begin evaluating further terms in your business, like:

- gross revenue

- net profit

- COGS, or cost of goods sold

- assets vs liabilities

If you feel like your business has grown, but you haven’t seen your bank account growing with it, there’s a good chance that it’s time you hired a professional bookkeeper to help you with your numbers.

This is especially true if you have ever felt like you needed an accounting degree just to make sense of your financials, or if you’ve ever found yourself late at night Googling what certain financial terms mean.

What a professional bookkeeping service will do for you is:

- Track profitability over time, and not just top-line revenue

- Help you identify areas of waste, or key goods or services that seem to sell well, but are actually costing you money

- Make sure your growth is sustainable, without you burning out as your business grows

If you find yourself working harder but not seeing more money in the bank, a good bookkeeper can help you figure out why as well as develop a plan going forward.

3) Tax Season is Stressful

If you find yourself dreading tax season each year, you are not alone. Tax preparation often evokes nightmares of scrambling to locate receipts, trying to remember what purchases were made the year before, and sometimes, even hoping and praying that big expense you made is tax deductible.

It’s why many business owners wait till the tax deadline to file their taxes. Worse, some business owners incur penalties when they find themselves a year or more behind on their taxes.

When you run a business, you know how important every dollar is, and these kinds of fees only hurt the growth of the business.

Fortunately, a professional bookkeeping service has a number of benefits for tax preparation. First and foremost, a professional bookkeeper will keep your records organized for you throughout the year.

Better yet, you reduce the risk of costly errors, or even missed deductions due to your lack of information around a tax code that seems to change every year.

Your bookkeeper will help you know what you can write-off, while keeping you ahead of the tax deadline with a process that feels like a breeze.

Running a business is hard enough as it is and with the stress that comes with it, there’s no reason for one date each year to be so painful.

4) You’ve Accidentally Mixed Personal and Business Finances

Understanding what is a personal expense and what is a business expense is a crucial concept in managing your financials correctly.

Unfortunately, today’s social media driven world also brings with it an endless amount of misinformation and clever tricks on how to reduce your tax bill.

Many of these tips are not applicable to all businesses, and they also do not always work in practice.

For example, you may have heard the rule for writing off business meals as:

“As long as you talk about business, you can write off the meal as a business expense.”

This has led to jokes about friends going out for a bite to eat, and then quickly shoehorning a comment about a meeting to qualify the meal as a business expense.

It’s not quite that easy, though, according to Decimal.com.

Business meals, for example, need to involve a meal that has a clear business purpose, something even the IRS has clarified.

So no, you can’t just mention a random meeting and always hope to mark the meal as a business expense.

Some of these things may seem obvious, but unfortunately, it’s not uncommon for a business owner to even accidentally mix personal and business finances.

Some business owners even mix-and-match personal and business accounts, with the plan to move money back and forth later.

This is not a best practice for business and can make things difficult, especially if you ever plan to get a loan for your business.

Fortunately, a professional bookkeeping service can help you manage your financials appropriately, while also correctly labeling transactions. A professional bookkeeper can also advise you on these kinds of expenses before you make them so that you don’t find yourself regretting a purchase later on.

5) You’re Applying for a Loan or Line of Credit

Cash is king in business, and managing a positive cash-flow business is a key part of running a successful brand. More often than not, business owners do not have the startup cash needed to grow their business.

Or, they have underestimated how much time or how costly it may be to get the business fully operational.

Applying for a loan or a line of credit is a common pathway for a growing business, yet business owners do not always understand the documents a bank will request for approval.

These kinds of documents usually include:

- Profit and loss statements (also known as a P&L)

- Balance sheets

- Cash flow statements

- Tax Returns

As you can see, if you’ve ignored the bookkeeping side of your business, or these documents are not up-to-date, it’s unlikely you’ll be approved for a loan or line of credit.

Worse, you would want to avoid misrepresenting any elements of your business, something that would cause immeasurably more problems for you down the road.

A professional bookkeeper helps ensure these documents are complete, correct, and most importantly, easy to present. This can then speed up your application process and make that loan or line of credit far more likely to be approved.

Do You Want to Understand Your Business Better?

Sometimes your business isn’t on fire, but as you feel the momentum of your business growing, you also recognize that you want to understand the ins and outs of it better.

It’s hard to make confident decisions about your business, like the next steps to scale your brand, or if that expensive marketing investment is worth the money, if you lack clarity on the financials of your business.

All in all, a professional bookkeeping service will help give visibility into the numbers of your business, as well as make sense of how your business is growing… or if it’s shrinking, and what you might want to do about it.

Better insights lead to better strategies, and how can you steer a ship if you don’t know where it’s going?

Accurate, timely bookkeeping is one of the core parts of a healthy foundation for any business. If you’ve found yourself struggling with one of the five problem areas described here, it might be time to bring in a professional.

Explore our bookkeeping services to see how we can support your business.